The history of the development of the UK North Sea reveals the influence of “first mover” companies who made early investments in oil & gas export pipeline infrastructure.

Shell & Exxon dominated activities in the Northern North Sea after leading investment in the Brent System and FLAGS gas line. BP and Shell & Exxon shared influence in the Central North Sea through the ownership of Forties Pipeline System and Fulmar Gas Line, respectively. Amoco and Phillips each controlled asset areas near the UK/Norwegian border through the CATS gas pipeline and Norpipe oil pipeline.

What is happening in the UK infrastructure connections for electricity today?

UK Net Zero 2050 goals are achieved, in part, by extensive electrification supported by a major expansion of renewable and other low-carbon power generation. This goal encourages UK connections with the grids in nearby countries.

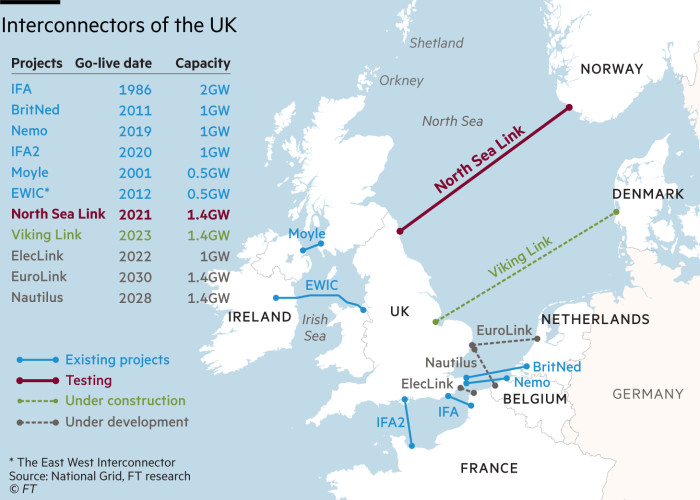

The existing UK electricity interconnectors are operated by the UK’s National Grid in partnership with the other county electrical transmission operators. The IFA (2 GW) & IFA2 (1 GW), Nemo (1 GW) and BritNed (1 GW) links are in place with France, Belgium and Netherlands, respectively. These interconnectors enable the UK to import low carbon electricity from Europe. The connectivity of the UK and Ireland electricity markets has been secured by the EWIC link (0.5 GW).

A new, and the world’s longest, interconnector, named North Sea Link (1.4 GW), has been installed between UK and Norway. It was commissioned in October 2021. This ties the UK to Norway’s hydro capacity. The length is 720 km. The cost was reported as GBP 1.7 Bln. A Viking Link (1.4 GW) is planned to be installed across similar distances between the UK and Denmark to enable the exchange of green electricity in 2023.

Even greater ambition is a proposed XLinks (3.6 GW) power project to bring Morocco electricity generated from solar to the UK. The length is 3800 km. The cost estimate is GBP 16 Bln.

What is happening in the infrastructure connections for CO2 storage?

A front runner CO2 project, named HyNet NW, plans to capture industrial CO2 in NW England & North Wales with both new & old pipelines and link to depleted Liverpool Bay gas fields, specifically the Hamilton, North Hamilton and Lennox fields, in the UK Sector of the Irish Sea.

Two other industrial clusters, named Net Zero Teesside & Zero Carbon Humberside, together East Coast Cluster, also look to transport captured carbon to an offshore saline aquifer (named Endurance Partnership) or the Hewitt/Viking depleted gas fields in the Southern North Sea using new pipelines.

Another CO2 project, named the Acorn Project, is set to link carbon capture from St Fergus industrial cluster in Scotland (and other CO2 volumes imported from elsewhere) with the depleted Goldeneye gas field in the Central North Sea using existing gas pipelines.

History shows pioneers in infrastructure investment are rewarded well for their strategic thinking. This strategic thinking often involves intuition & creativity rather than rearrangement of established ideas.