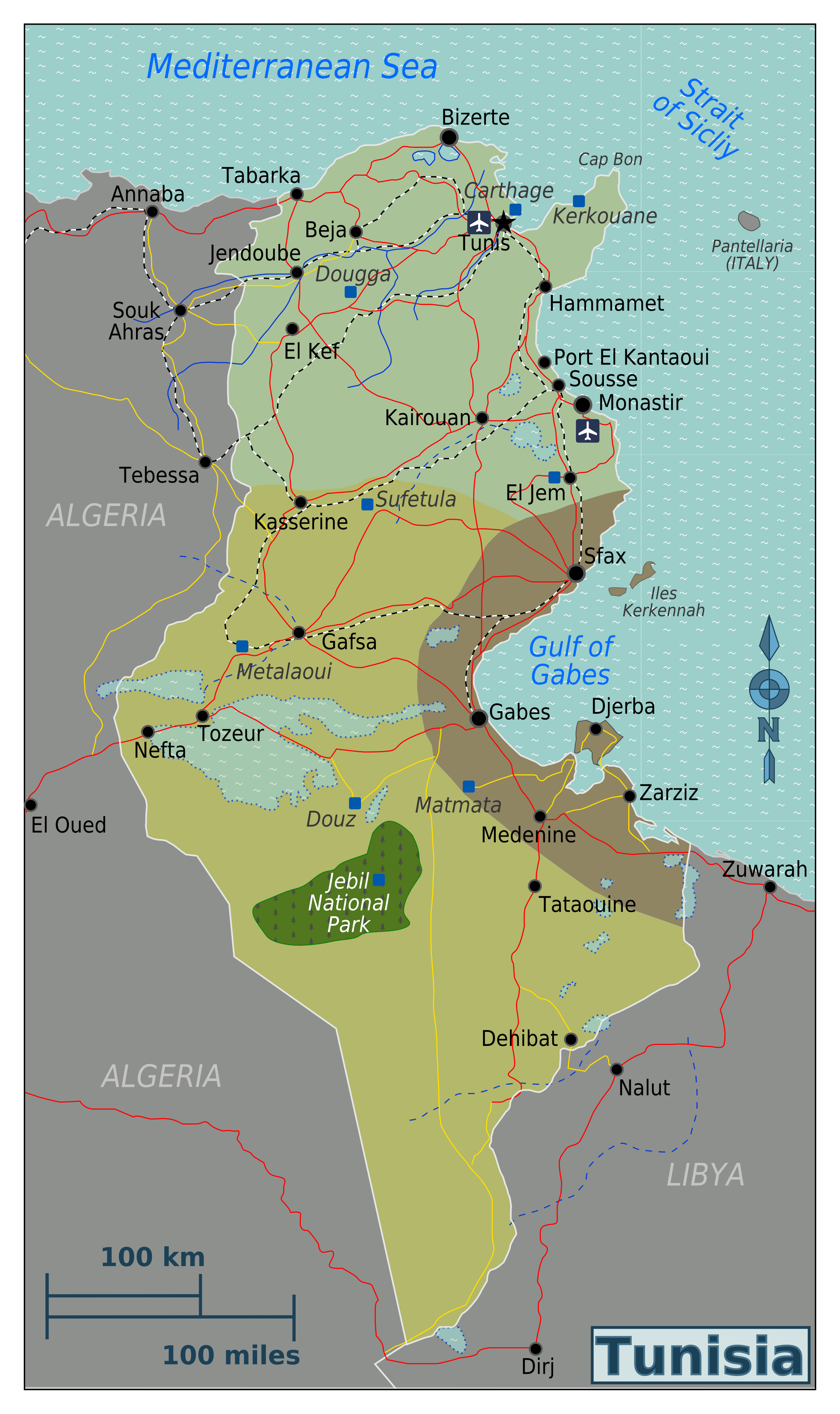

Tunisia, a country in North Africa with 11.5 million people, is facing difficult times. An energy balance deficit has grown over the past decade and is now at 50% of total energy consumption. Tunisia is heavily dependent on imported petroleum. It is struggling to unlock its remaining conventional hydrocarbon reserves of 350-970 MMbbl oil and 2.35-3.5 Tcf gas, as cited by the Tunisia Ministry of Industry & SMEs in October 2018. Oil & gas production in 2019 has declined to some 40,000 b/d and 250 MMscf/d. The 2011 Tunisia revolution that triggered the “Arab Spring”, to oust autocracy in favour of democratic rule, has resulted in ten Tunisia Governments in eight years. This constant change has affected economic prosperity. Protests seeking local employment have targeted oil field facilities affecting production levels.

Yet Tunisia is still open to upstream oil & gas investors. It has stable hydrocarbon laws and an attractive tax/royalty fiscal system where government take is typically limited to 60%. Investors can be rewarded in foreign currency from oil sales. The country has extensive oil & gas processing facilities and a large pipeline network, all with spare capacity. A geological record of 1200 wells drilled in Tunisia can be accessed. Local Tunisian oil field service companies have wide expertise including production operations.

Nevertheless, a gradual departure of major western energy companies from Tunisia has occurred over recent years as companies withdraw to low cost, low carbon, heartlands. Shell and ENI are rumoured to be seeking buyers for their Tunisia interests in 2022. Even some smaller established players, OMV, Perenco, Mazarine Energy, Serinus Energy, ADX Energy have diluted part of their Tunisia interests.

Who will produce the last barrel of oil in Tunisia ? Probably local Tunisian oil field service companies for Tunisia onshore. It is less clear what will happen for Tunisia offshore. In this end game, some smaller entrepreneurial western energy companies are still entering Tunisia pursuing exploration, in both onshore – Hunt, Upland Resources, ATOG, Zenith Energy & YNG – and offshore – Panoro Energy, Dunraven Resources & Panoceanic Energy.

Tunisia has significant solar potential for electricity generation, currently sourced 97% from natural gas. Solar replacing gas is very important for Tunisia energy security. Tunisia has a target to lift the 373 MW solar capacity in 2018 to 3815 MW by 2030. Tunisia is more advanced than many other countries with its renewable energy regulatory framework. Some western energy companies operating onshore oil & gas have also been awarded permits for small solar projects in Tunisia. Others are likely to follow.

Tunisia seeks to maximise its hydrocarbon reserves to deliver long term value to its citizens as it looks to make the difficult transition to renewable energy.

Black Duck Resources can assist new entrants wishing to invest in Tunisia upstream oil & gas.