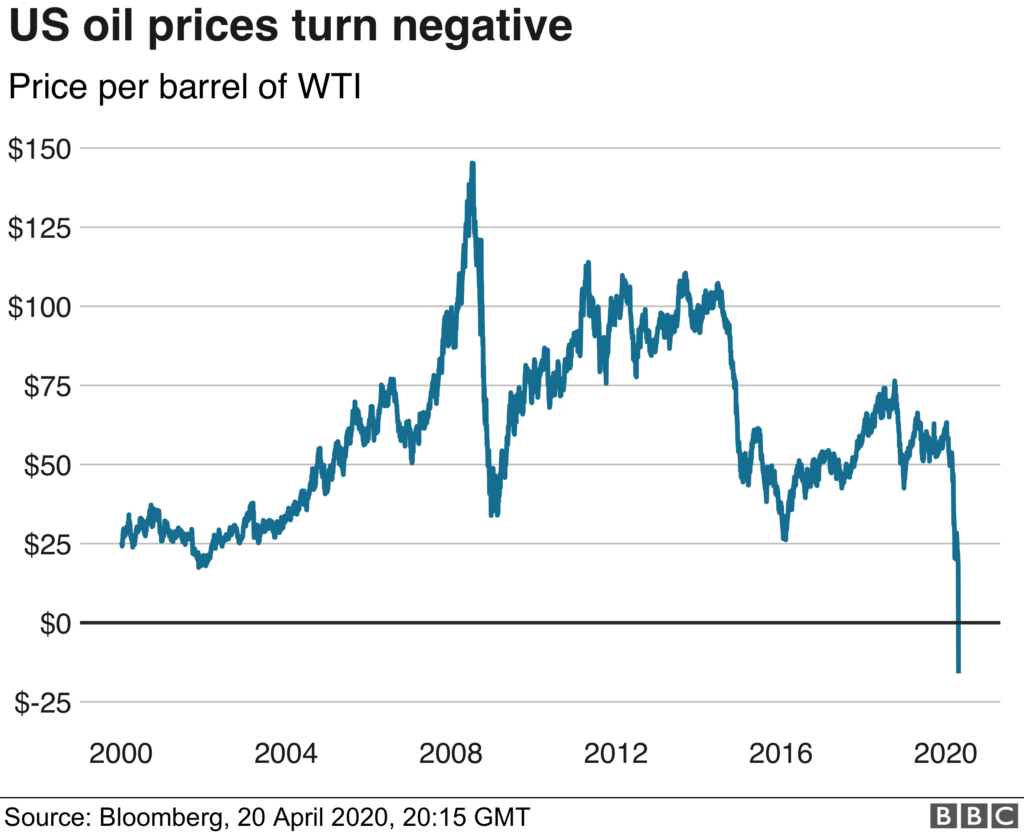

The global oil demand of 100 million barrels a day dropped 10-15% due to the COVID-19 pandemic. This has resulted in oil prices plummeting to low levels in the $20-40 per barrel range, remarkably even below zero on one day in April 2020, not seen since the downturns in 2015 & 2009 and the prolonged low oil prices of 1986-2004.

If the low oil demand world is sustained, this will mean investment will reduce in exploration and many shale oil, oil sand, shallow & deep water offshore development projects will no longer be viable. Investment will likely return to low cost onshore OPEC opportunities, where the petroleum industry started.

Learnings from the 2015 oil price downturn were summarised by a Society of Petroleum Engineers editorial which read:

“Jobs are uncertain or scarce. Profitability is challenged. Bankruptcy looms. Projects are being cancelled. Deals are dropped or delayed. It seems there is bad news everywhere.

It is important to:

1. Be Innovative – Previous business plans may no longer be viable in the current price environment;

2. Be Curious – This is a good time to look for new ideas; and

3. Cut Costs – Now is the time to be diligent, even ruthless, with cutting costs. In the end, you will be more secure and better prepared when good times return”.

New ways of office working are already apparent in 2020, Eg accelerating digitisation & virtual meetings, but the petroleum industry remains a person-dependent industry in field operations and refineries.

These are tough times.

But look for the opportunity in every disaster ….