Algerian officials shared the detail of the 2019 Algeria Hydrocarbon Law to a large audience in London on 17 January 2020. The pitch was as follows:

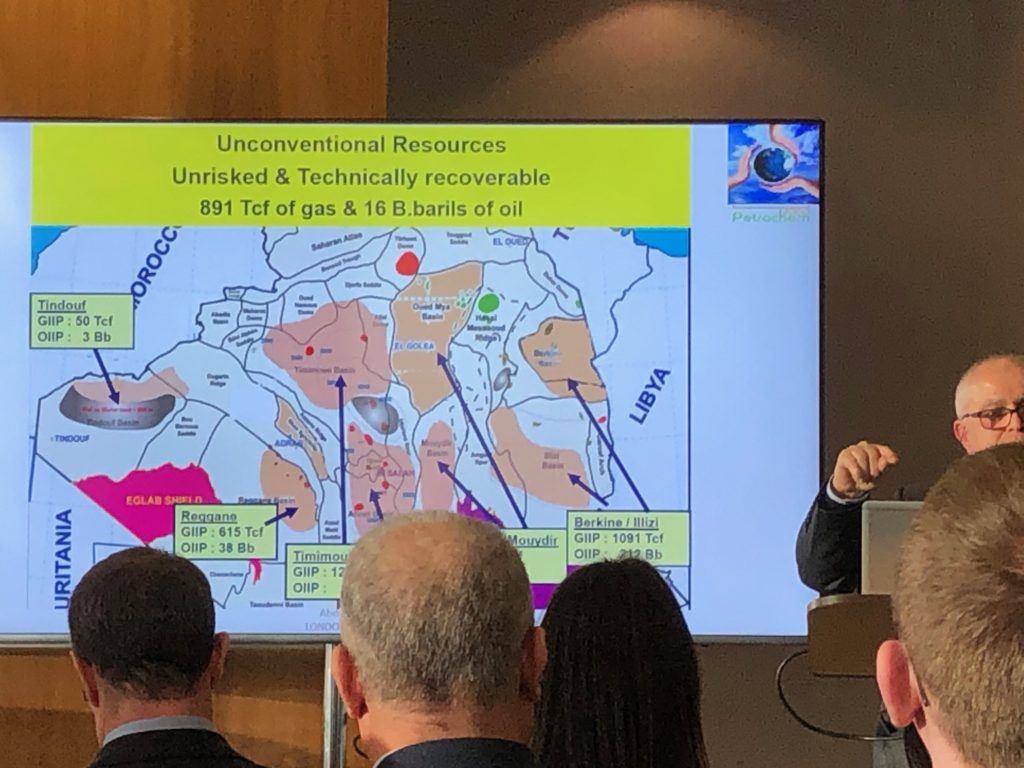

There is a lot of oil and gas in Algeria. Mr Abdelmajid Attar, consultant, former CEO of Sonatrach and former Minister of Water Resources, reminded the audience only half of the 500 conventional discovered oil/gas accumulations in Algeria are under exploitation and that unconventional undeveloped oil/gas volumes in place in Algeria are massive (891 Tcf gas-in-place and 16 Billion barrels oil-in-place) with attractive shale well test rates of 18,000 m3/day (or 0.6 MMscf/d). There is spare capacity in the extensive Algeria oil/gas export pipeline infrastructure to European markets.

Algeria Hydrocarbon Law is based on Law 86-14 as amended by Law 05-07. Investors are offered a tax/royalty arrangement, although named a production sharing contract, with the national oil company, Sonatrach, holding a 51% interest in the operating joint venture. Over the past 20 years, Algeria has tinkered with fiscal terms for royalty, petroleum revenue tax and income statement tax, in addition to the surface, water and flaring charges. The harsh terms in 2006 resulted in only one block being awarded to international oil companies. The 2013 Hydrocarbon Law improved fiscal terms slightly for conventional oil/gas and expanded the law to allow unconventional development. This attracted some additional cautious investors but has resulted in few new developments.

Algerian officials claim that the 2019 Hydrocarbon Law offers more contract flexibility for an investor and that the significant fiscal changes lower the Government Take from over 90% to the 60-70% range:

- Royalty

10% flat rate, with potential to negotiate to 5% flat

rate in special cases

(was 5.5-23% for conventional oil/gas dependent on production rates and zone and 5% for unconventional hydrocarbons). - Petroleum

Revenue Tax (TRP) 10-50%, with potential to negotiate to 10-20% in special cases,

dependent on R-Factor

(was 20-70% for conventional oil/gas and 10-40% for unconventional hydrocarbons dependent on different R-Factor) - Income

Statement Tax (ICR) 30% flat rate

(was 19-30% dependent on production rates rising to 80%)

Algeria seems serious in this new attempt to encourage international investors.